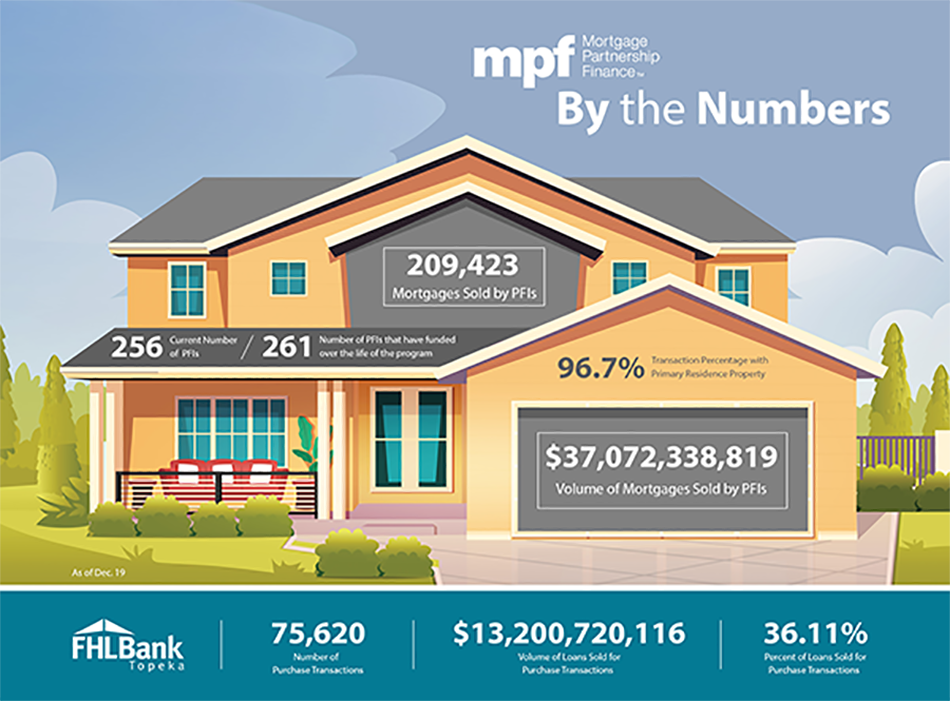

MPF Program

At FHLBank Topeka, you are more than our customer — you're our member and shareholder.

As a cooperative, your strength is our strength. The MPF Program helps you make profitable residential mortgage loans in your community while returning FHLBank Topeka profits to you in the form of dividends.

Through a partnership with the Federal Home Loan Bank of Chicago, FHLBank Topeka purchases your eligible conventional and government loans through the Mortgage Partnership Finance® (MPF® ) Program, a high-performance secondary market option that provides increased profitability through competitive pricing and ongoing credit enhancement income.

Applications

MPF Products

The MPF Program offers a variety of product structures to accommodate different lender preferences and risk.

- MPF Original - lets you originate, sell, and service fixed-rate, residential mortgage loans receive credit enhancement income based on the performance of the loans.

- MPF 125 - offers you the ability to originate, sell, and service fixed-rate, conventional residential mortgage loans and receive credit enhancement income for sharing the credit risk.

- MPF Government - allows you to sell fixed-rate mortgage loans that are insured or guaranteed by government agencies.

- MPF Government Mortgage-backed Securities (MBS) - purchases your government loans and then aggregates and pools them into securities guaranteed by the Government National Mortgage Association.

- MPF Xtra - offers you the option to sell fixed-rate, conforming loans into the secondary market without retaining the credit risk.

MPF Servicing Options

The MPF Program offers flexible servicing options

Service your MPF loans and receive a servicing fee, or sell your servicing for an upfront service-released premium. We make it easy. Retain the servicing on your MPF loans or sell your servicing to one of our approved aggregators. Find out more about your servicing options.

MPF Operational Guides

As a newly approved Participating Financial Institution (PFI) under the MPF Program, or an FHLBank Topeka member financial institution considering the MPF Program, you undoubtedly have questions about how our secondary market program works. Listed below are helpful resources to assist you in implementing the MPF Program at your institution or your decision making process to become a PFI.

PIECE BY PIECE, STEP BY STEP – HOW-TO DOCUMENTS THAT WALK YOU THROUGH MPF PROGRAM PROCESSES:

- A Simple Guide to Becoming a PFI – a timeline and guide to obtaining PFI approval status.

- Establishing a Master Commitment – the document that is needed before loan sales can begin.

- Credit Enhancement Estimator - Interactive Entry | File Upload – how to estimate the amount of credit risk your institution can expect

- Loan Presentment – steps for completing an electronic form to get your loan data to us.

- Batch Processing – steps for getting your loan data to us using a batch and submit process.

- Rate and Fee Schedules – help in accessing and understanding our rate sheet.

- Delivery Commitments and Fundings – help with two key transactional processes under the MPF Program.

- Servicing Retained – shows what’s involved in keeping the servicing rights on loans sold to us.

- Custody – provides help in getting the right documents correctly and timely to the MPF Program Custodian.

- Quality Control – references pre and post closing MPF Program quality control requirements.

- Reporting Risk-Based Capital under Basel III – covers an FFIEC call requirement for some PFIs.

- Community Bank Leverage Ratio – explains the CBLR framework, which provides a simple measure of capital adequacy

- Product & Pricing Engine Considerations – enhance your process when selling to multiple investors

FAQs

HOW DO I CALCULATE A PAIR-OFF FEE?

Compare the premium or discount (agent fee) percentage at the time the Delivery Commitment (DC) was locked to what the agent fee percentage would be for a similar transaction the day the DC is being paired off. The agent fee used to compare to the original fee is adjusted for the time remaining on the delivery commitment. So, if the original delivery commitment was a 30-day and there are 10 days remaining, the original 30-day price would be compared to the current 10-day price.

For MPF Traditional Product DCs with dollar amounts delivered below the DC tolerance: If the agent fee percentage on the day of the pair-off is less, there will be no pair-off fee assessed. Otherwise, take the absolute value of the change in price (from original lock day to current day price) times the amount non-delivered. The pair-off calculation references schedules in effect at 3:30 p.m. on the date the commitment expires.

For MPF Traditional Product DCs with dollar amounts delivered above the DC tolerance: If the agent fee percentage on the day of the pair-off is greater, there will be no pair-off fee assessed. Otherwise, take the absolute value of the change in price (from original lock day to current day price) times the amount non-delivered.

Actual pair-off fee calculations can be provided by the MPF Servicer Center (877.345.2673) or through the eMPF website.

HOW DO I GET ACCESS TO THE EMPF WEBSITE?

The eMPF website is located here. To gain access, you'll need to complete a Delegation of Authority form or a Delegation of Authority Security Admin form to designate a security admin to enable access to update eMPF authority directly within eMPF. Please contact the MPF department at 866.571.8171 to obtain the form.

WHAT ARE THE DELIVERY COMMITMENT TOLERANCES IN THE MPF PROGRAM?

MPF Delivery Commitments have a built-in tolerance. For each delivery commitment, the acceptable note range for mortgages delivered under that commitment is +/- 25 basis points (.25%) from the specified note rate, or the limit of the price range, whichever is more restrictive.

- For delivery commitments of $2 million or less there is a 5% (.05) tolerance above or below the commitment amount.

- For delivery commitments greater than $2 million, the tolerance is 1% (.01) above or below the commitment amount.

HOW AM I PAID FOR LOANS SOLD TO COLONIAL SAVINGS?

Colonial Savings Service Released Premiums are paid on the 5th business day of the month following the loan being delivered and accepted by Colonial Savings. These funds are deposited into your primary FHLBank demand deposit account.

HOW AM I PAID FOR LOANS SOLD TO SPECIALIZED LOAN SERVICING (SLS)?

Specialized Loan Servicing (SLS) will email a Funding Memo to the Selling PFI on a per Serviced Loan basis. The Selling PFI is to confirm the amounts in the Funding Memo and if the amounts are correct, select the Accept hyperlink embedded in the body of the Funding Memo email. Upon receipt of the approved Funding Memo email, SLS will wire the SRP payment, net of the required escrow balance and fees, on the SLS Funding Date as specified on the Funding Memo directly to the PFI.

WHAT TYPES OF MODIFICATIONS ARE ELIGIBLE?

You can re-amortize and modify loans that have received large curtailments under the following conditions:

- Minimum allowable curtailment for a modification is the greater of $5,000 or 10% of the current principal balance of the mortgage, and the curtailment was applied within 60 days prior to the note modification date.

- Modification allows for full amortization of the mortgage by its maturity date.

- A modification cannot extend the terms of the note or change the note rate.

Reference MPF Servicing Guide Chapter 2.10.4 for complete details.

ARE STREAMLINE REFINANCES ALLOWED IN THE MPF PROGRAM?

No, effective Oct. 14, 2022, Expedited (streamline) refinances are no longer eligible for delivery as MPF Traditional Loans.

DOES THE MPF PROGRAM PURCHASE GOVERNMENT LOANS?

All fixed-rate FHA/VA, HUD Section 184 and RHS Section 502 loans are eligible to be sold under the MPF Program. You must be approved through the specific government agency in order to sell these loans under the MPF Program. A separate and specific government master commitment is required.

WHO SHOULD I CONTACT TO APPLY FOR THE MPF PROGRAM?

Please contact the MPF Account Manager, Chris Endicott, at 785.478.8164. Applications are also available on our website.

WHAT IS THE COST TO APPLY FOR THE MPF PROGRAM?

There is no cost to apply for the MPF Program.

WHAT IF I DON’T WANT TO RETAIN THE SERVICING ON THE LOANS I SELL?

The MPF Program offers two different options if you do not wish to retain the servicing for loans sold. A Concurrent Servicing Sale option or a Whole Loan Servicing transfer is available. You have the ability to sell the servicing on these loans as you sell them under the program. Both options will pay you a Servicing Released Premium (SRP).

WHO IS RESPONSIBLE FOR UNDERWRITING THESE LOANS SOLD UNDER THE MPF PROGRAM?

As the loan originator, you are ultimately responsible for underwriting the loans you sell under the Program. You can manually underwrite the loan or use the automated underwriting systems of Desktop Underwriter and Loan Product Advisor. Another option is to outsource the underwriting through a mortgage insurance company or other group.

HOW DO I ACCESS THE MPF SELLING GUIDELINES?

The MPF Selling guides can be found at www.fhlbmpf.com/guides.

Resources and Latest News

Whether you want to watch, listen or read, we have content that fits your preferences.

All Resources