We recently completed a comprehensive review of our products and pricing methodology. As a result, FHLBank Topeka’s board of directors approved changes designed to help us continue to deliver the value you expect from our advance products.

Simplified Pricing

We’ve traditionally offered a volume discount when pricing advances, where larger advances received lower rates than smaller advances. Effective immediately, we have revised our approach to advance pricing to eliminate the volume discount and offer the same rate to all members. We believe this revised approach, which provides improved pricing to many members, is more consistent with our role as your cooperative and enhances our ability to serve as a partner to our members in meeting their wholesale funding needs.

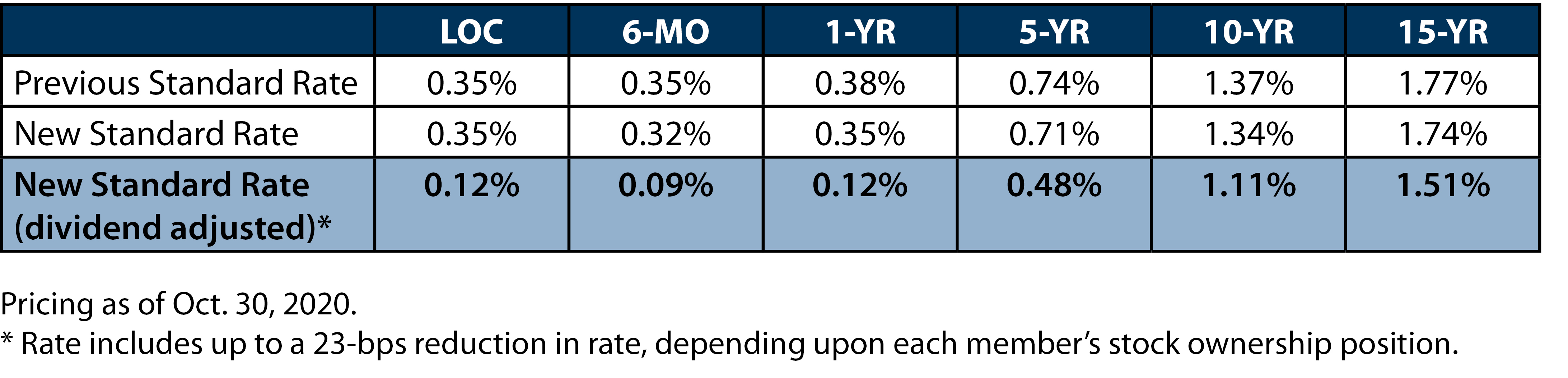

The table below is a selection of available terms and illustrates how our new pricing will benefit you, especially when you consider FHLBank’s strong dividend.

Product Modifications

We plan to modify a few of our product offerings.

Line of Credit – Our review noted that some of the documentation related to our Line of Credit (LOC) product suggests drawn funds are guaranteed for the full term of the LOC commitment, which is currently a year. Under Federal Housing Finance Agency regulations that govern our advance pricing, a materially higher rate would be required than the overnight rate we’ve traditionally charged on LOC.

Consequently, we are rolling out a new product called the Overnight Line of Credit (OLOC) on Jan. 4, 2021, to give members pricing consistent with overnight funding. The new OLOC will still allow daily draws and paydowns and be priced the same as our old LOC with the understanding the advances mature daily.

While we’ll continue to offer both products for a while, we’re planning to move all existing LOC balances to the OLOC automatically on Jan. 4. There is no action needed on your part, and we’ll provide additional details starting in November.

- Convertible Advances – We’re placing a moratorium on convertible advances because of the difficulty in pricing the conversion feature. Our intent is to develop a similar product that allows FHLBank to call the advance. This advance structure is typically attractive in a higher interest rate environment where members can achieve lower costs by selling an option(s) that allows the advance to be called (previously converted). We anticipate having an alternative product available early next year.

- Adjustable Rate Advances Indexed to Secured Overnight Financing Rate (SOFR) – As the capital markets transition away from instruments tied to the London Interbank Offered Rate (LIBOR), market liquidity and acceptance of debt and other instruments tied to SOFR has improved. As a result, the available maturities on adjustable rate advances indexed to SOFR are being extended from 2 years to 10 years.

Eliminated Products

Based on our review, we will discontinue two advance types effective Dec. 1, 2020. Neither product was widely used by our membership.

- Standby Credit Facility - As an alternative, members may prefer our overnight products available until 4 p.m. CT.

- Member Option Advance –As a replacement for this product, we would suggest you consider callable advances. The cost of the member call is included in the stated advance rate as opposed to the upfront fee associated with the Member Option Advance.

Collateral Changes

Our board of directors also approved changes to our Schedule of Eligible Collateral in our online Member Products and Services Guide. Watch for an additional email on Monday outlining these changes, including more details related to the acceptance of interest only on mortgages on multifamily real property and commercial real estate loans as well as the use of eNotes, both of which are much-awaited additions for many members.

Questions

We would be happy to talk through any of these changes. We know our members have a lot of information coming to them each day from various sources. Please contact your regional account manager or the Lending Desk at 800.809.2733 with your questions.