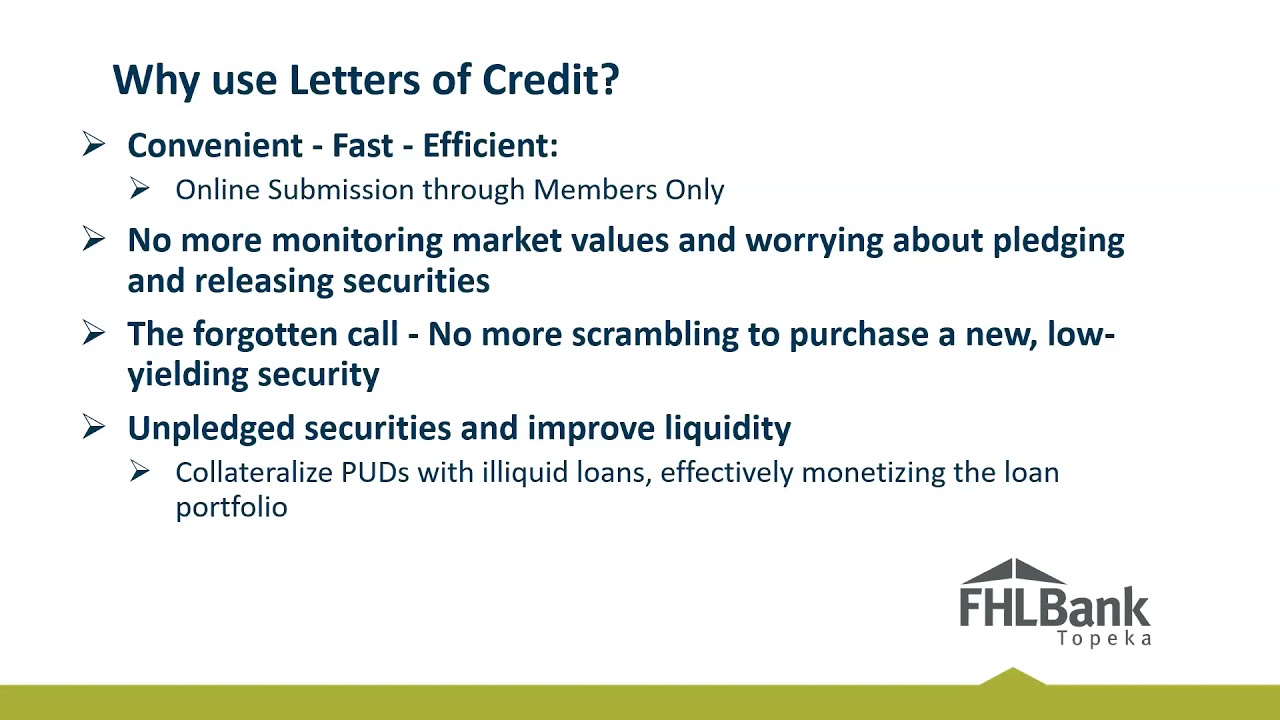

Letters of Credit

Our Letters of Credit are the simple way to secure public unit deposits in Colorado, Kansas, Nebraska and Oklahoma.

ELECTRONIC. INSTANT. ON-DEMAND. FHLBank Topeka's letters of credit have always been the easy choice for securing public unit deposits. The FHLBank Topeka Standby Letter of Credit is issued to the municipality or state that is depositing funds with your institution. You set the amount and the maturity date and let our helpful staff do the rest.

Getting Started

Once you experience our blue ribbon, same-day service, you won't want to secure funds any other way. You can quickly and easily complete your Letter of Credit on our Members Only site in most cases.

Please contact the Lending Desk for more information.

Choosing Letters of Credit

Check out our resources below to see why the letter of credit is a smart choice for your financial institution.

Watch our 2021 Letters of Credit webinar to learn why it can work for your institution.

Resource for Members

Your Financial Institution and Letters of Credit

- Gives you more flexibility

- Strengthens your depository relationships by guaranteeing the return of funds

- Promotes higher yields on assets by reducing portfolio investments in low-yielding Treasury and agency securities, and increasing allocation to higher-yielding securities and loans

- Eliminates monitoring market values and maturity dates because our letter of credit's value never changes

- Reduces paperwork and administrative fees associated with pledging and releasing securities and replacing maturing or called instruments

- Provides immediate confirmation after the easy application on our Members Only site

- 0.125% per annum on the day of issue ($125 minimum fee) for simple letters of credit

- Fees on letters of credit of $5 million or more may be charged on a quarterly basis

- See our Member Products and Services Guide for full pricing schedule