In writing this message, I looked back at what I shared with you in my pre-pandemic first quarter message of 2020. The message was hopeful and grateful. That message is still appropriate today in spite of all we have experienced since mid-March and the recent surge in COVID-19 cases in our four-state district.

I am hopeful that a vaccine for COVID-19 will reach all of us soon and the tragic numbers of infections and related deaths will fall drastically. I am hopeful that the political and social environment will become unified and all of us will reflect on more of our similarities rather than our differences. I am also very hopeful that the economy will continue its recovery and we will see small businesses, farmers and our communities at large begin again to prosper.

I am grateful for you and your trust and loyalty to FHLBank Topeka. We know that local financial institutions are vital to the survival and growth of every community across our district. This is why our partnership with you and our ability to provide the liquidity you need to meet the needs of your customers and communities is so important.

I am also grateful and proud of the FHLBank employees. Their dedication to providing you excellent service whether they are working in the headquarters or at home has allowed us to continue to seamlessly serve you as we always have without disruption.

2020 Financial Highlights

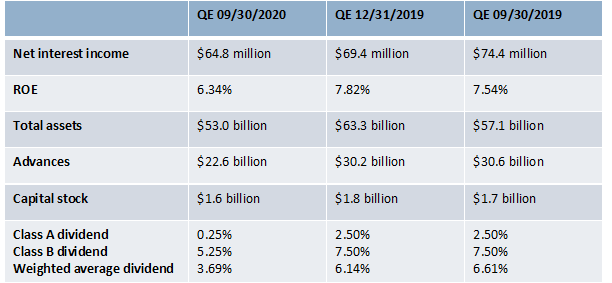

Even in such a challenging financial environment, FHLBank Topeka continues to perform well and is a stable and reliable partner for your wholesale liquidity and funding needs. Below is a high-level overview of our third quarter financials. For more details, please refer to our November 10, 2020, SEC filing.

The table that follows reflects the impact of the increased liquidity on member balance sheets and the corresponding decline in our advance balances and total assets. However, our capital has remained extremely steady as we instituted an MPF stock requirement to help in capitalizing our growing mortgage portfolio. While the increase in capital combined with slightly lower net interest income has resulted in a decline in ROE, the return remains strong and supports attractive dividends relative to other market yields.

Recent Product and Pricing Changes

On Oct. 30, you should have received an email about some changes we’re making to pricing and products as a result of a comprehensive review of our offerings. You can find the full details on our website.

- Simplified Pricing – We’ve removed the volume discount on advances and are now offering the same low rates to all members.

- Line of Credit – We are rolling all Line of Credit balances to our new Overnight Line of Credit product on Jan. 4 to better reflect the commitment terms of the product with no changes in our pricing for the product. Nothing is needed from our members to enact this change.

- Convertible Advances – We’ve placed a moratorium on this advance type and are working on an alternative product for next year.

- SOFR-indexed Adjustable Advances – Due to the improvement in the market acceptance of debt and other instruments tied to the Secured Overnight Financing Rate (SOFR), we extended the maximum term on adjustable rate advances indexed to SOFR from two years to 10 years.

- Eliminated Products – Two rarely used advances – the Standby Credit Facility and the Member Option Advance - were eliminated effective Dec. 1.

- Letters of Credit Stock Requirement – This new requirement, starting Jan. 22, 2021, will help capitalize our exposure while returning a patronage dividend that effectively reduces the cost of your letters of credit.

Serving Your Communities

FHLBank Topeka is very different than other wholesale funding alternatives. The value of your FHLBank membership includes more than having access to reliable low-cost funding. FHLBank provides additional programs, such as the Affordable Housing Program (AHP), Homeownership Set-aside Program (HSP) and our holiday #500forGood program, that help you serve and build your communities.

In December, the board will review the proposed grant recipients of this year’s $13.3 million in AHP dollars. Earlier this year, $7.2 million was available through our members to help low-income first-time homebuyers through the HSP. We also are happy to offer small grants to 16 of our members through #500forGood. The 16 winners will be announced soon.

We will continue our strong support for affordable housing next year. Watch for an email outlining the total dollars available through AHP and HSP in early 2021. Please remember when selecting your source for wholesale funding that these programs/services are only available to the extent that our members use FHLBank’s products and services that contribute to the cooperative revenue.

Members Only Enhancements

Our latest enhancement to our Members Only website is the ability to submit letter of credit requests online. This feature makes the process even easier. The next Members Only initiative is automation of authorizations and simplification of the permissions process related to our Members Only portal. This upgrade will make it less frustrating and time-consuming for your Members Only administrator while supporting future online banking enhancements. We will continue to listen to you and respond to your desires to improve convenience and ease of use.

Member Meetings and Webinars

On Nov. 13, we held our first virtual member meeting. You can view a recording here. More than 200 live participants heard from Kansas City Federal Reserve President Esther George and several FHLBank Topeka staff.

For the past four months we have held a series of webinars ranging from deposit pricing strategies to how to stay invested. You can find recordings of past webinars on our website.

Now is the time to be forward thinking so that you are well positioned for when we return and create our new normal. Please contact your regional account manager to help you with various tools offered by FHLBank Topeka, such as liquidity management, identifying additional collateral, deposit pricing and loan funding strategies. Then, you will be ready to act when the economy picks back up and begins running on all cylinders. And, as indicated previously, I am hopeful it will very early in 2021.

On behalf of all FHLBank Topeka business partners, it is our pleasure to serve you and your communities. We are thankful for your membership and wish you and your families the very best throughout the holiday season.