At its meeting last week, FHLBank Topeka’s board of directors approved changes to its Member Products Policy. Details are available in the online Member Products and Services Guide and are effective April 1, 2024.

Lending Value Changes

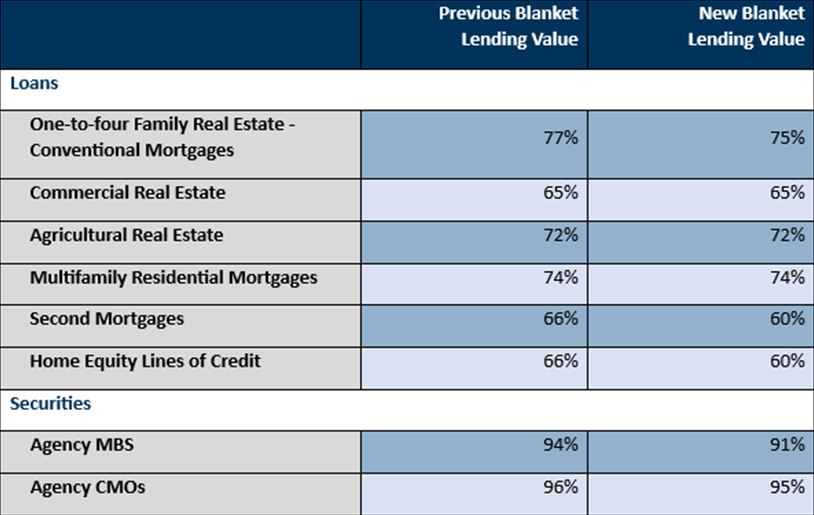

As we shared earlier this month, lending values for several widely pledged mortgage loan and securities categories are changing. As a reminder, the purpose of the assigned lending value is to ensure that if your cooperative must liquidate the collateral pledged (underlying securities or loans), sufficient remaining value from the sale of the loans or securities will cover a member’s outstanding obligations.

Lending values are generally decreasing due to greater market price volatility and market value declines associated with rising interest rates since March 2022, as well as some erosion in credit quality of certain asset types. The most notable changes impact one-to-four family residential real property, securities and other real-estate related collateral.

See the table below for a comparison of our most popular categories for the blanket (QCD) lending value. Visit our website for the full schedule of eligible collateral, including delivered (limited) and delivered (expanded) lending values.

Eligibility Change - Private Issue Securities

To help facilitate increased pledging of securities collateral, underwriting requirements for Private Issue CMOs, Private Issue Residential Mortgage Pass-Through Securities, and Other Private Issue CMOs have been updated to allow for up to five percent tolerance for FICOs below 660, as it pertains to the underlying loans supporting the security. An additional haircut will be applied for securities that have FICOs below 660 within the described tolerance level; however, this change should be very helpful in allowing more members the ability to successfully pledge these types of securities.

Contact Us

If you have any questions, please contact Lance Liby, chief credit officer, Tom Bliss, director of credit administration, or Dedra Duran-Gray, director of financial services, at 785.233.0507.