Financial Intelligence

Financial Intelligence

Financial Intelligence

February 20, 2026

Financial Intelligence Live Webinar Feb. 19, 2026

Financial Intelligence

Financial Intelligence

December 2, 2025

Could a Pre-Funding Strategy Help Your Institution as Rates Fall?

Financial Intelligence

Financial Intelligence

February 20, 2026

Financial Intelligence Live Webinar Feb. 19, 2026

Financial Intelligence

Financial Intelligence

December 2, 2025

Could a Pre-Funding Strategy Help Your Institution as Rates Fall?

Financial Intelligence

Financial Intelligence

November 24, 2025

Financial Intelligence Live Webinar Nov. 20, 2025

Nov. 20, 2025, presentation slides and recording

Financial Intelligence

Financial Intelligence

October 24, 2025

Refinance Smarter

Why Smaller Rate Drops Matter More Today

Financial Intelligence

Financial Intelligence

November 24, 2025

Financial Intelligence Live Webinar Nov. 20, 2025

Nov. 20, 2025, presentation slides and recording

Financial Intelligence

Financial Intelligence

October 24, 2025

Refinance Smarter

Why Smaller Rate Drops Matter More Today

Financial Intelligence

Financial Intelligence

September 4, 2025

Financial Intelligence Live Webinar Sept. 3, 2025

Sept. 3, 2025, presentation slides and recording

Financial Intelligence

Financial Intelligence

April 14, 2025

Identifying Strategy Biases ... and How to Avoid Them

Simple tactics to succeed in any rate environment

Financial Intelligence

Financial Intelligence

March 5, 2025

A Critical and Powerful Management Tool: Easy Steps to Evaluate Marginal Cost of Funds

Financial Intelligence

Financial Intelligence

September 4, 2025

Financial Intelligence Live Webinar Sept. 3, 2025

Sept. 3, 2025, presentation slides and recording

Financial Intelligence

Financial Intelligence

April 14, 2025

Identifying Strategy Biases ... and How to Avoid Them

Simple tactics to succeed in any rate environment

Financial Intelligence

Financial Intelligence

March 5, 2025

A Critical and Powerful Management Tool: Easy Steps to Evaluate Marginal Cost of Funds

Financial Intelligence

Financial Intelligence

February 25, 2025

Financial Intelligence Live Webinar Feb. 20, 2025

Feb. 20, 2025, presentation slides and recording

Financial Intelligence

Financial Intelligence

February 25, 2025

Financial Intelligence Live Webinar Feb. 20, 2025

Feb. 20, 2025, presentation slides and recording

Financial Intelligence

Financial Intelligence

November 22, 2024

Financial Intelligence Live Webinar November

Financial Intelligence

Financial Intelligence

November 22, 2024

Financial Intelligence Live Webinar November

Financial Intelligence

Financial Intelligence

August 30, 2024

Financial Intelligence Live Webinar August 2024

Aug. 29, 2024, presentation slides and recording

Financial Intelligence

Financial Intelligence

August 30, 2024

Financial Intelligence Live Webinar August 2024

Aug. 29, 2024, presentation slides and recording

Financial Intelligence

Financial Intelligence

August 22, 2024

Quarter Two Economic Updates for Colorado, Kansas, Nebraska and Oklahoma

Financial Intelligence

Financial Intelligence

August 22, 2024

Quarter Two Economic Updates for Colorado, Kansas, Nebraska and Oklahoma

Financial Intelligence

Financial Intelligence

August 21, 2024

Additional Low Loan Balance Pricing Tiers for MPF® Conventional and Traditional Products

Financial Intelligence

Financial Intelligence

August 21, 2024

Additional Low Loan Balance Pricing Tiers for MPF® Conventional and Traditional Products

Financial Intelligence

Financial Intelligence

June 18, 2024

Registration for Financial Intelligence Live Webinars

Financial Intelligence

Financial Intelligence

June 18, 2024

Registration for Financial Intelligence Live Webinars

Financial Intelligence

Financial Intelligence

May 30, 2024

Economic Updates for Colorado, Kansas, Nebraska and Oklahoma

First quarter economic update

Financial Intelligence

Financial Intelligence

May 30, 2024

Economic Updates for Colorado, Kansas, Nebraska and Oklahoma

First quarter economic update

Financial Intelligence

Financial Intelligence

May 22, 2024

Financial Intelligence Live Webinar May 2024

May 21, 2024, presentation slides and recording

Financial Intelligence

Financial Intelligence

May 22, 2024

Financial Intelligence Live Webinar May 2024

May 21, 2024, presentation slides and recording

Financial Intelligence

Financial Intelligence

March 26, 2024

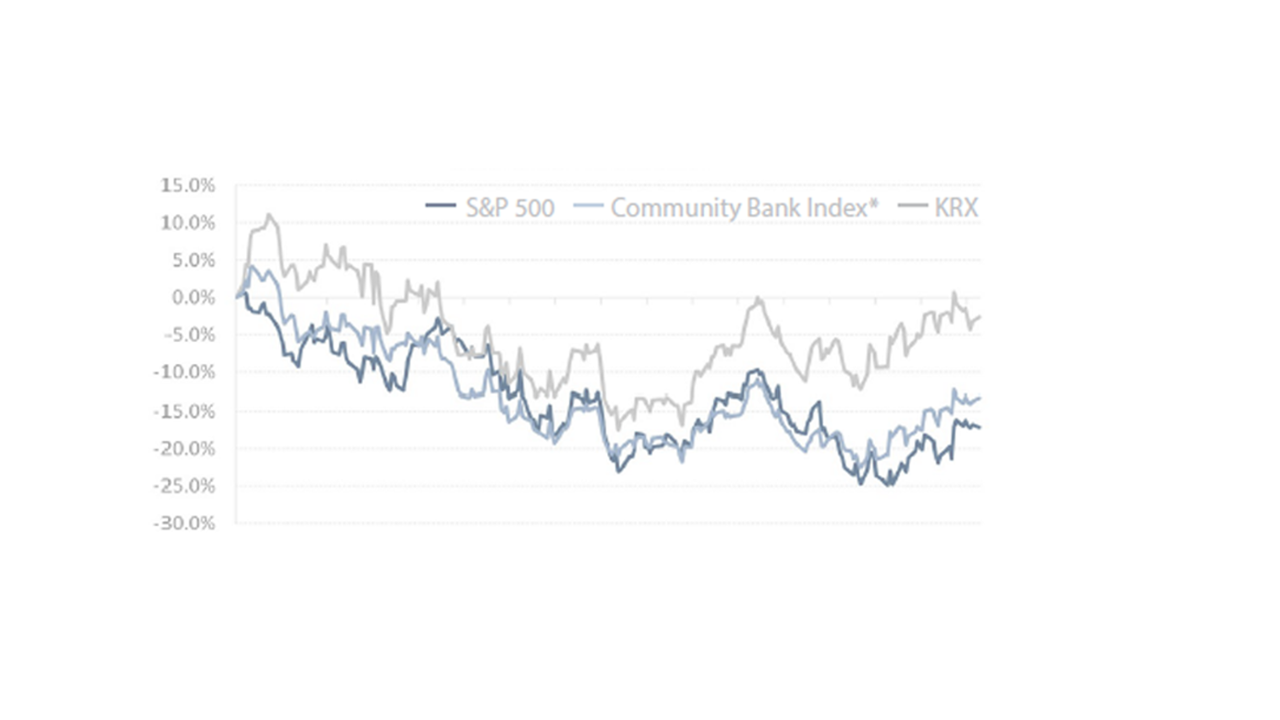

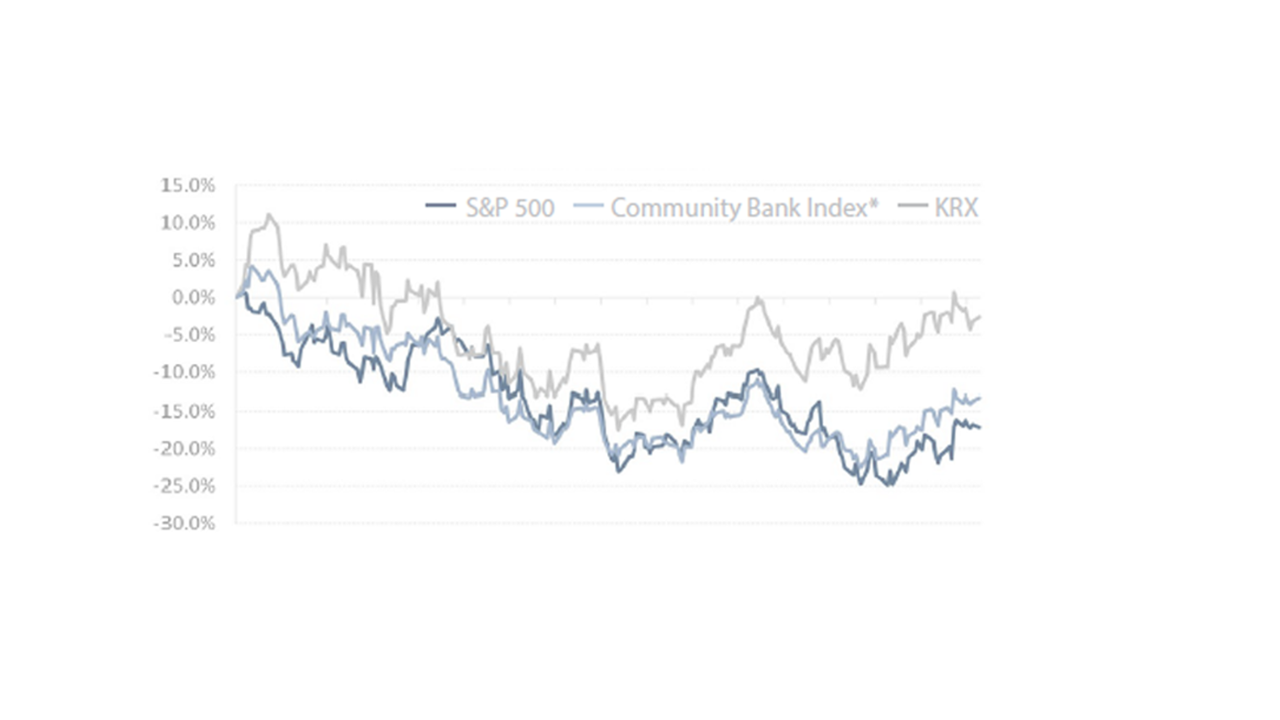

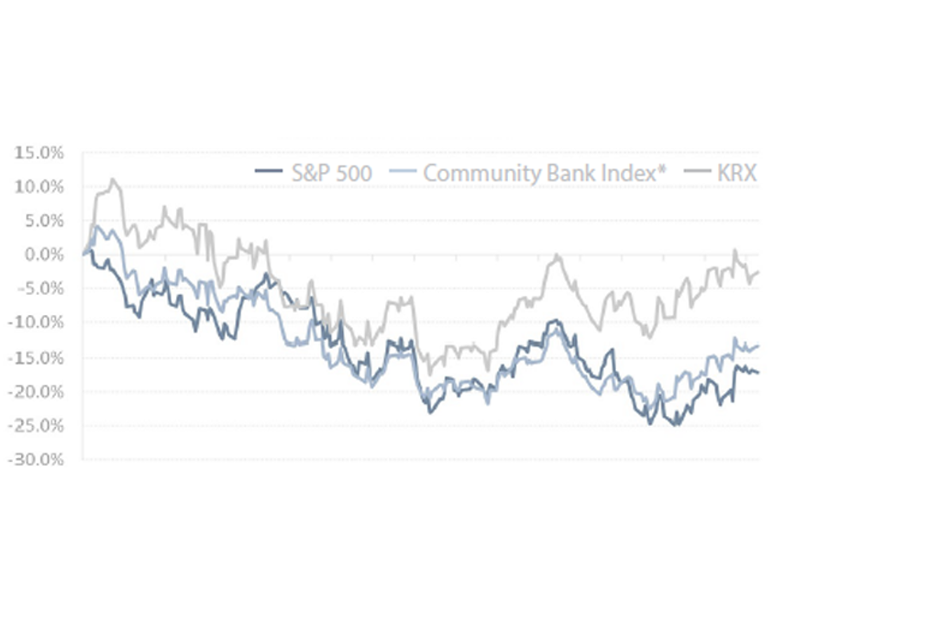

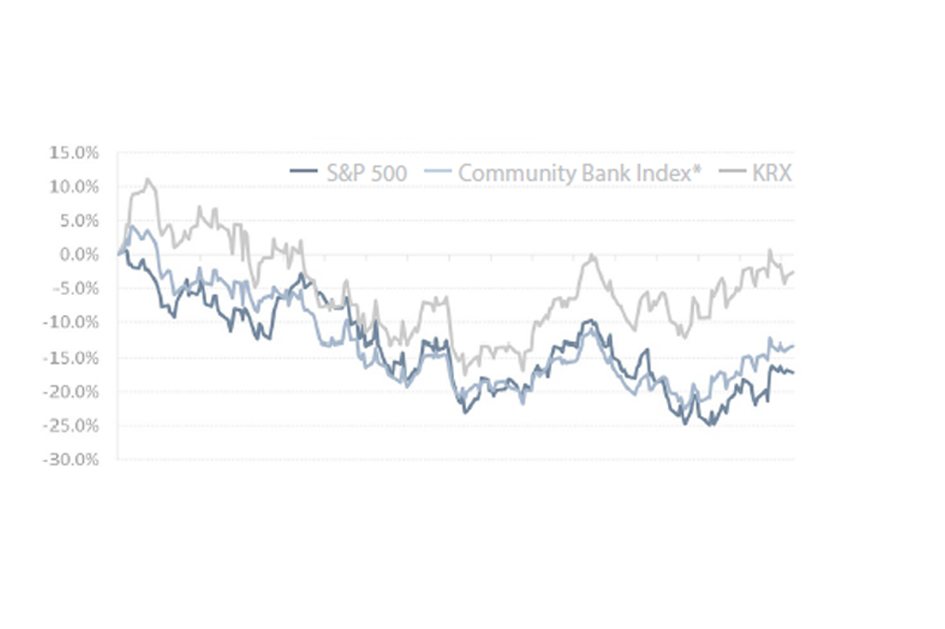

Q4 2023 Community Financial Institution Trends

Financial Intelligence

Financial Intelligence

January 22, 2024

Modern Liquidity Considerations

Revisiting outdated loan-to-deposit/share ratios

Financial Intelligence

Financial Intelligence

March 26, 2024

Q4 2023 Community Financial Institution Trends

Financial Intelligence

Financial Intelligence

January 22, 2024

Modern Liquidity Considerations

Revisiting outdated loan-to-deposit/share ratios

Financial Intelligence

Financial Intelligence

January 8, 2024

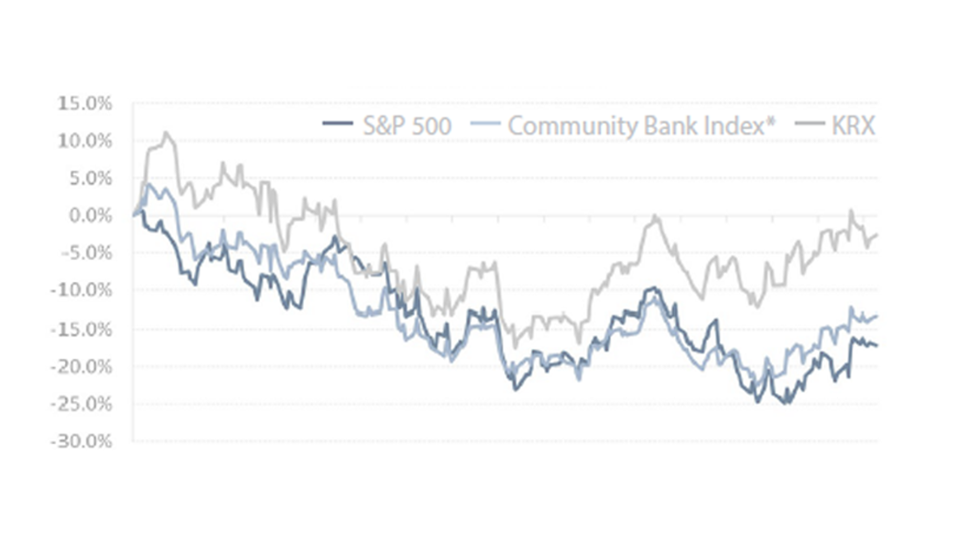

Q3 2023 Community Financial Institution Trends

Financial Intelligence

Financial Intelligence

January 8, 2024

Q3 2023 Community Financial Institution Trends

Financial Intelligence

Financial Intelligence

October 6, 2023

Q2 2023 Community Financial Institution Trends

The second quarter member trend report prepared by FHLBank Topeka's Member Solutions team is now available.

Financial Intelligence

Financial Intelligence

October 6, 2023

Q2 2023 Community Financial Institution Trends

The second quarter member trend report prepared by FHLBank Topeka's Member Solutions team is now available.

Financial Intelligence

Financial Intelligence

July 18, 2023

First Quarter 2023 Economic Update

Optimism has returned to the economic fold as first quarter 2023 GDP growth well exceeded forecasts for most states.

Financial Intelligence

Financial Intelligence

July 18, 2023

First Quarter 2023 Economic Update

Optimism has returned to the economic fold as first quarter 2023 GDP growth well exceeded forecasts for most states.

Financial Intelligence

Financial Intelligence

July 7, 2023

Set the Stage for Your Liquidity Needs

Building Your Access to FHLBank Funding

Financial Intelligence

Financial Intelligence

July 7, 2023

Set the Stage for Your Liquidity Needs

Building Your Access to FHLBank Funding

Financial Intelligence

Financial Intelligence

June 26, 2023

Q1 2023 Community Financial Institution Trends

Financial Intelligence

Financial Intelligence

June 26, 2023

Q1 2023 Community Financial Institution Trends

Financial Intelligence

Financial Intelligence

April 26, 2023

Fourth Quarter 2022 Economic Update

Fourth Quarter 2022 Economic Update

Financial Intelligence

Financial Intelligence

April 26, 2023

Fourth Quarter 2022 Economic Update

Fourth Quarter 2022 Economic Update

Financial Intelligence

Financial Intelligence

April 25, 2023

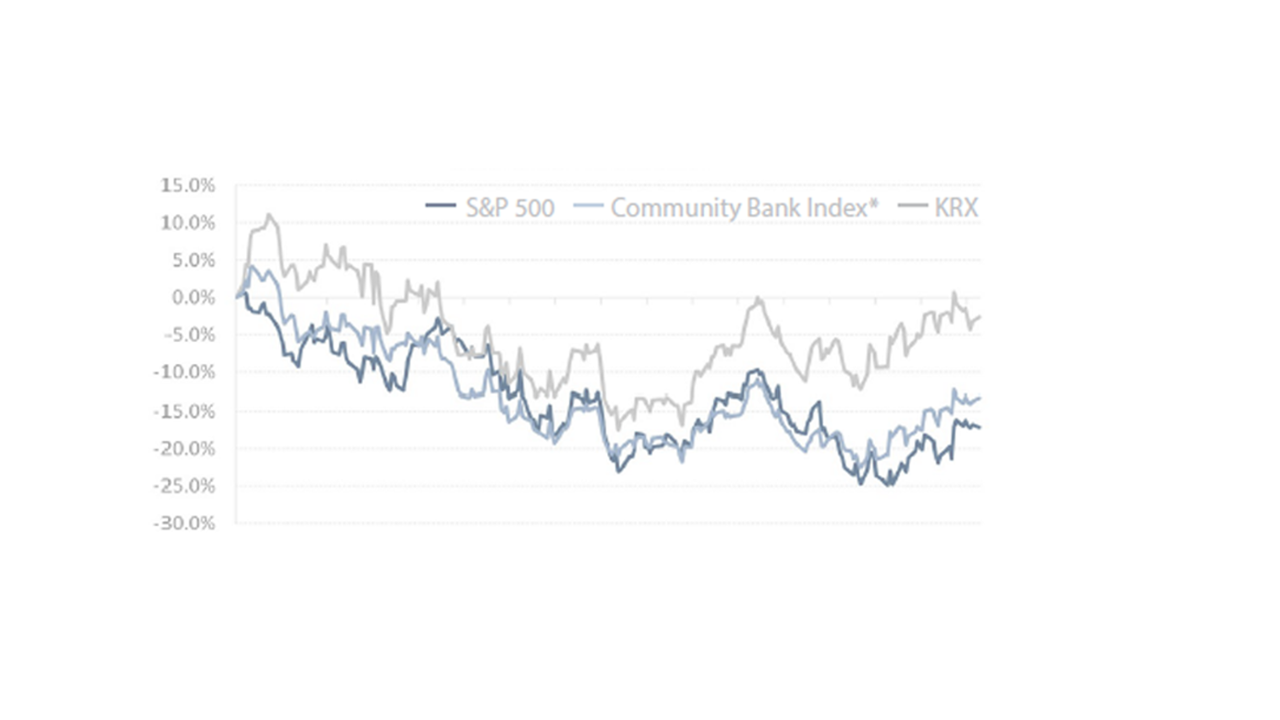

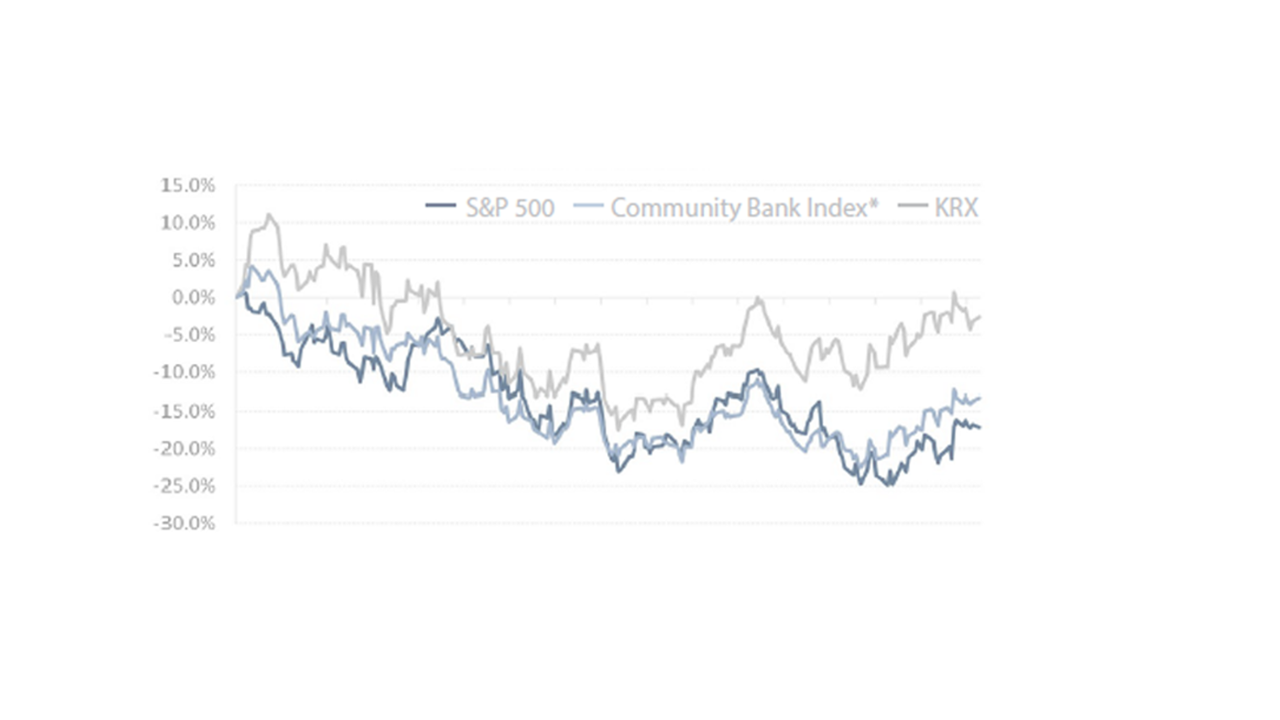

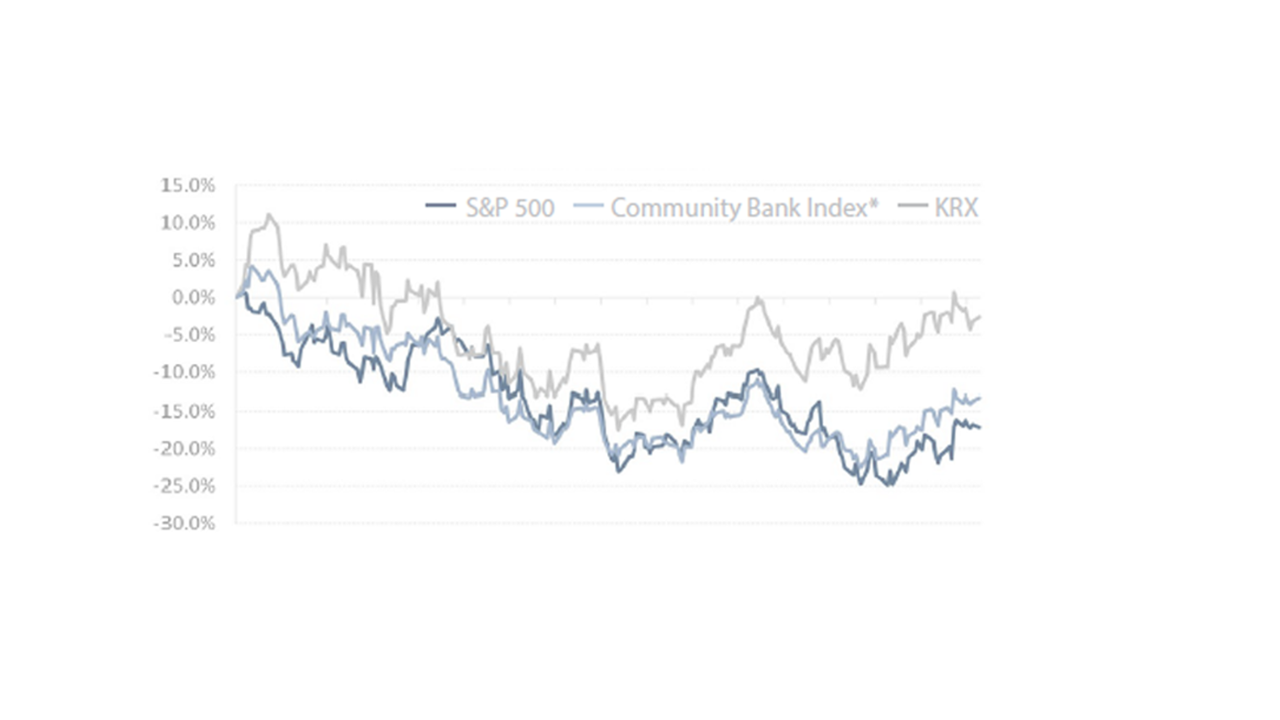

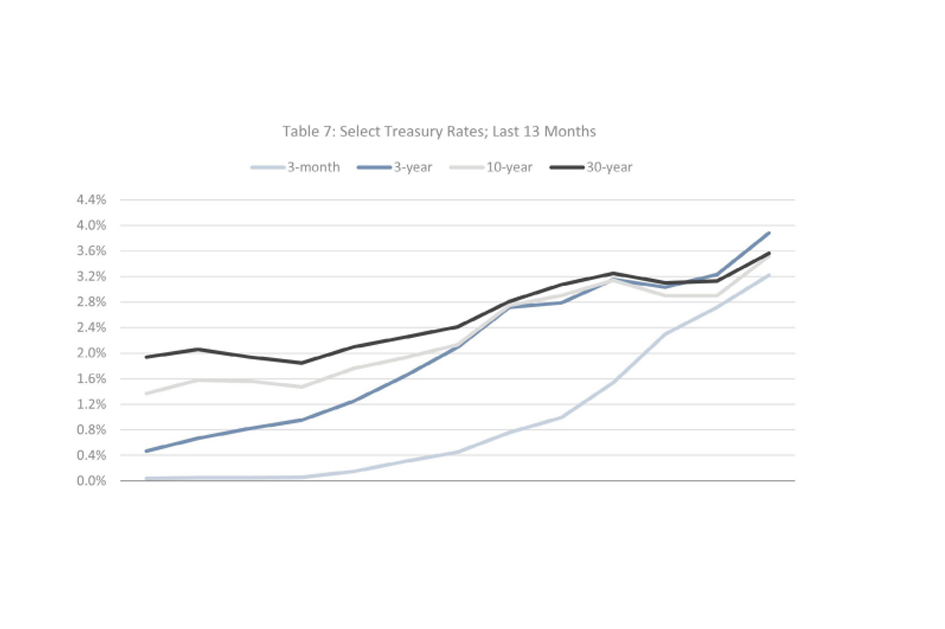

Liquidity Risk Management: More Than Checking a Box

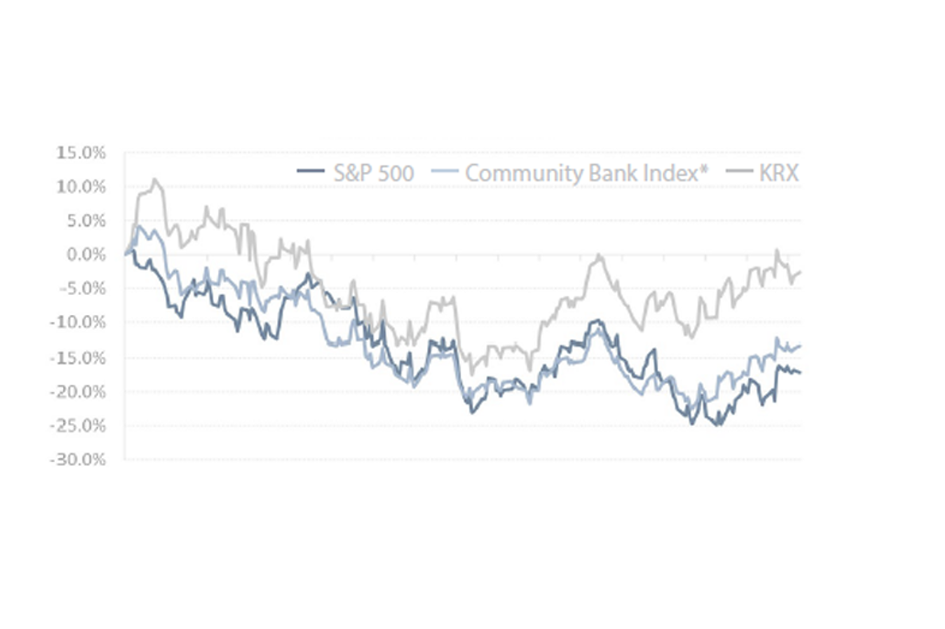

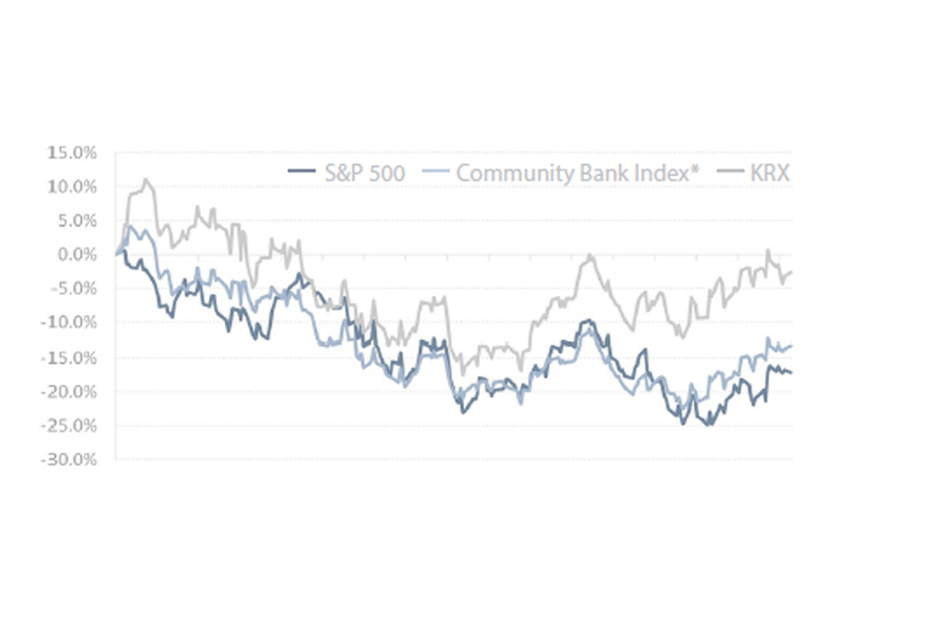

The recent bank failures of Silicon Valley Bank and Signature Bank have shown that liquidity risk can produce a bank failure instantly versus a slower, asset quality-related failure.

Financial Intelligence

Financial Intelligence

April 25, 2023

Liquidity Risk Management: More Than Checking a Box

The recent bank failures of Silicon Valley Bank and Signature Bank have shown that liquidity risk can produce a bank failure instantly versus a slower, asset quality-related failure.

Financial Intelligence

Financial Intelligence

April 13, 2023

How Loan Balance Pricing Works

On April 10, 2023, FHLBank Topeka activated loan balance pricing via the MPF Traditional Product.

Financial Intelligence

Financial Intelligence

April 13, 2023

How Loan Balance Pricing Works

On April 10, 2023, FHLBank Topeka activated loan balance pricing via the MPF Traditional Product.

Financial Intelligence

Financial Intelligence

April 7, 2023

Low Loan Balance Pricing

Processing a mortgage involves costs, and most of those costs don’t change because of the loan amount.

Financial Intelligence

Financial Intelligence

April 7, 2023

Low Loan Balance Pricing

Processing a mortgage involves costs, and most of those costs don’t change because of the loan amount.

Financial Intelligence

Financial Intelligence

February 15, 2023

Third Quarter 2022 Economic Update

As expected, economic growth in the third quarter of 2022 rebounded into positive territory, buoyed by strong consumer spending despite rising rates and high inflation.

Financial Intelligence

Financial Intelligence

February 15, 2023

Third Quarter 2022 Economic Update

As expected, economic growth in the third quarter of 2022 rebounded into positive territory, buoyed by strong consumer spending despite rising rates and high inflation.

Financial Intelligence

Financial Intelligence

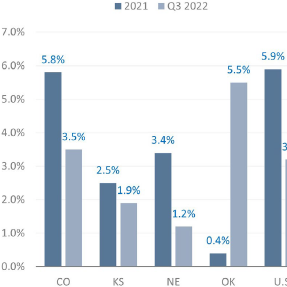

December 13, 2022

3Q 2022 Community Financial Institution Trends

Quarterly Analysis for 3Q 2022 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

December 13, 2022

3Q 2022 Community Financial Institution Trends

Quarterly Analysis for 3Q 2022 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

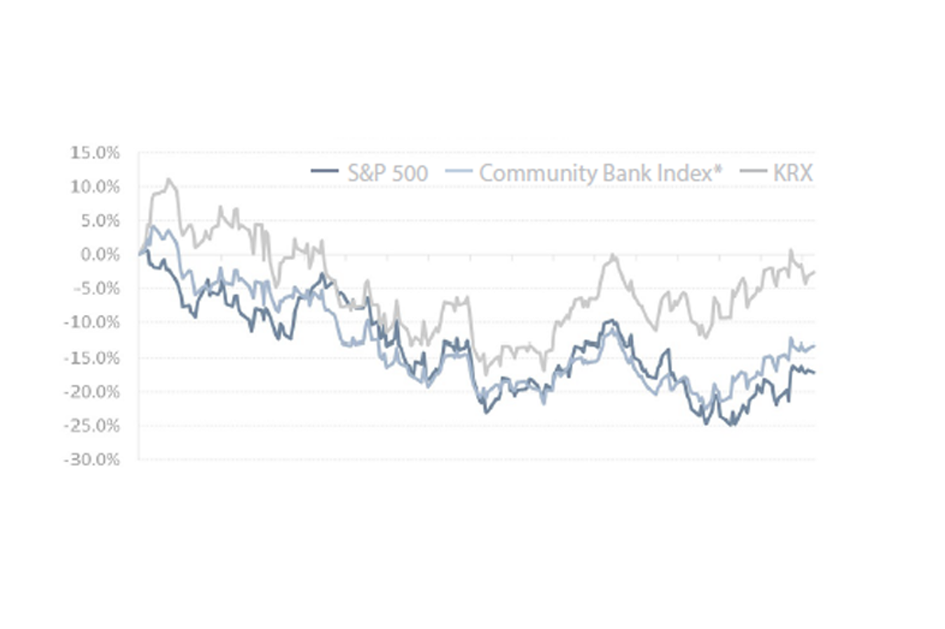

November 8, 2022

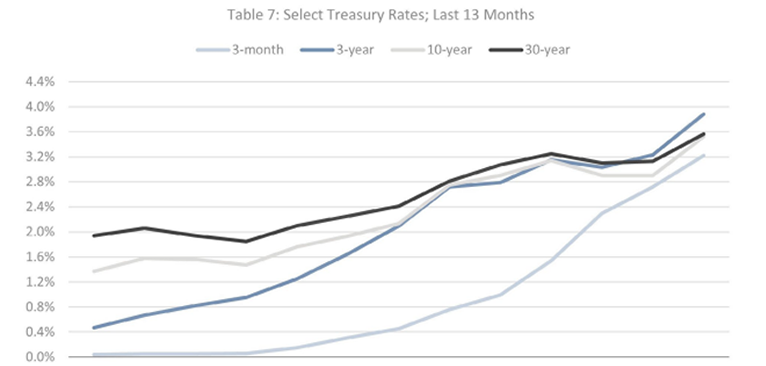

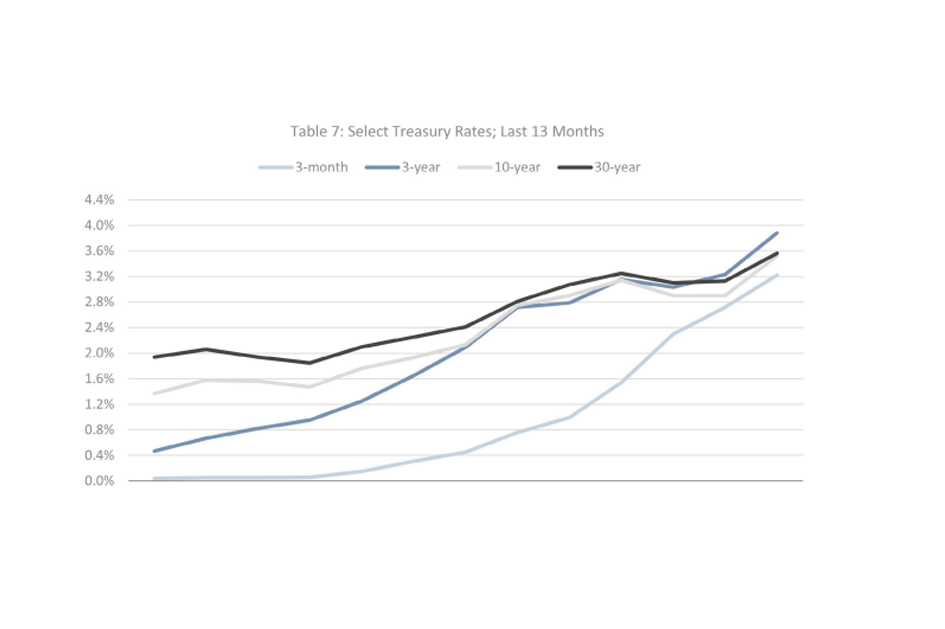

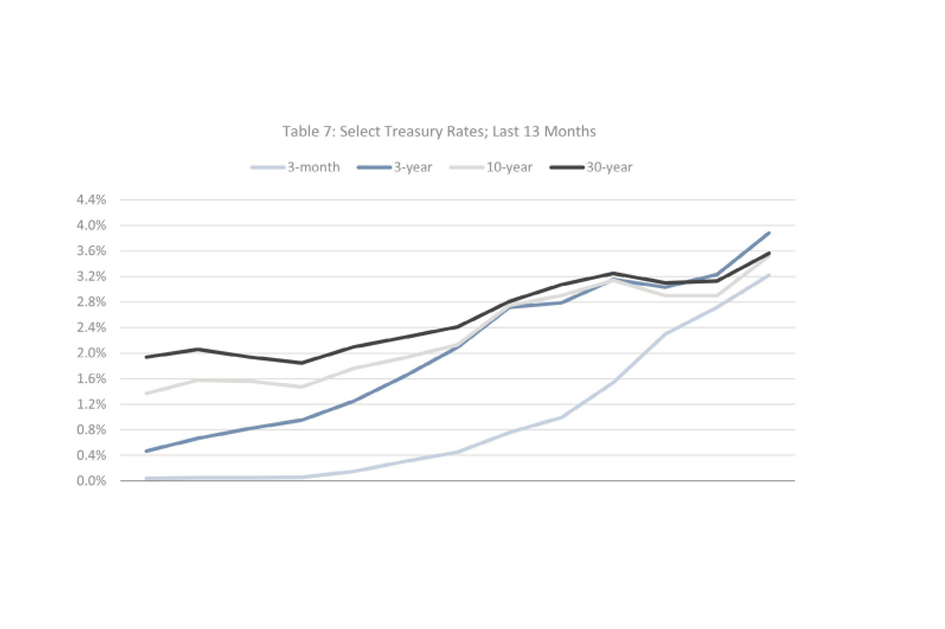

Second Quarter 2022 Economic Update

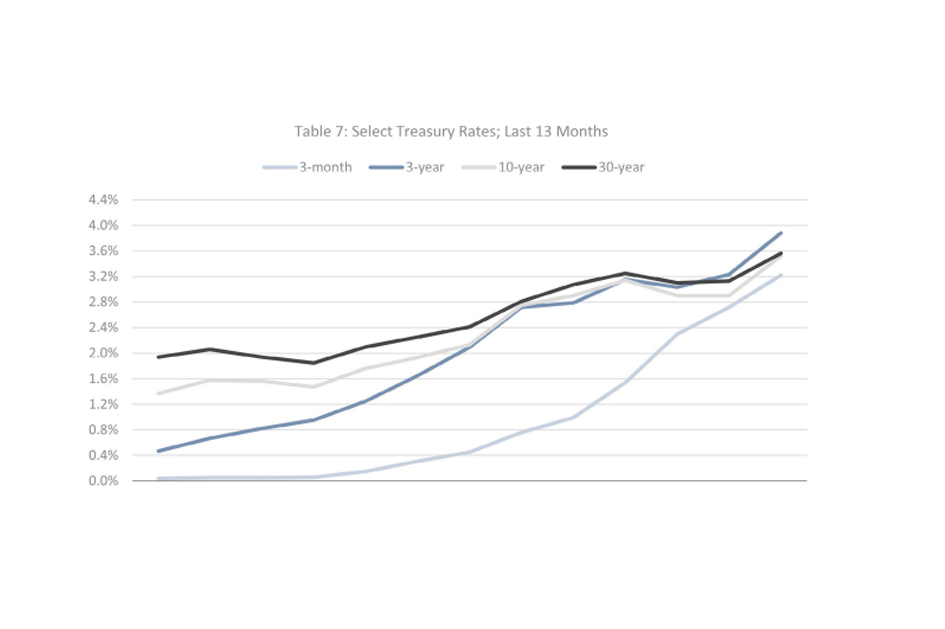

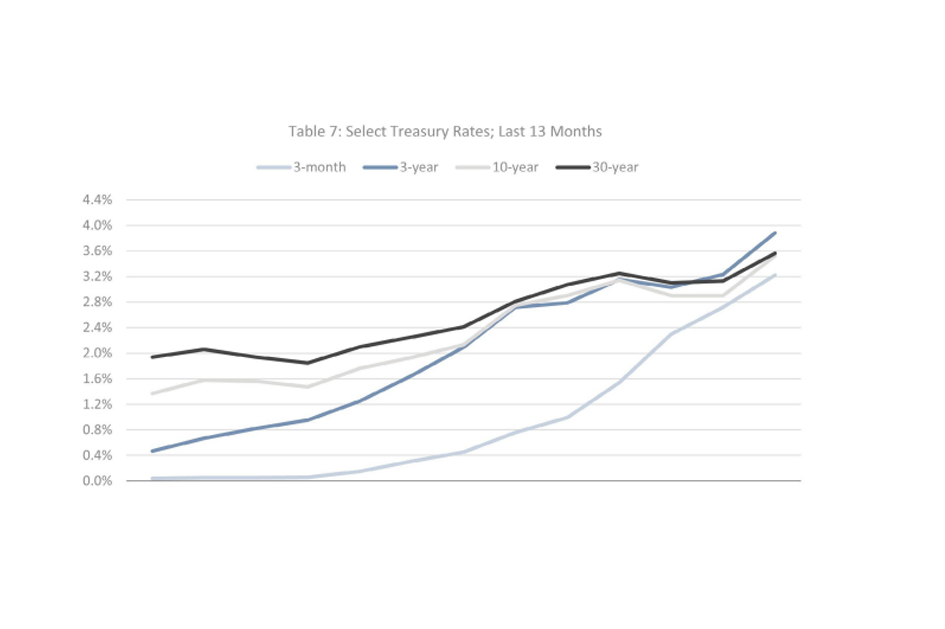

Despite strength in labor-related indicators and updated forecasts predicting positive economic growth in the third quarter of 2022, expectations remain that the U.S. economy will soon be in a recession.

Financial Intelligence

Financial Intelligence

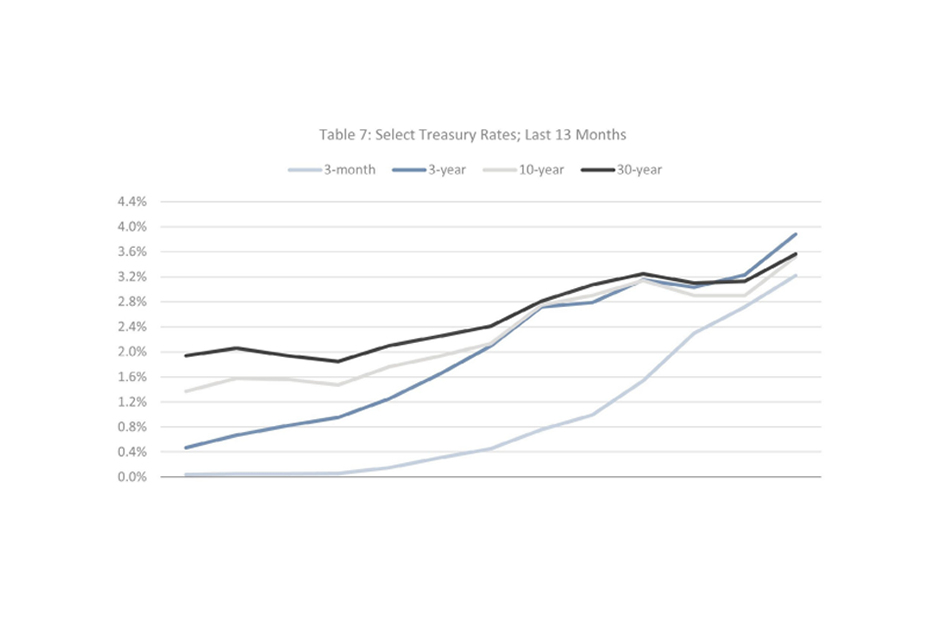

August 8, 2022

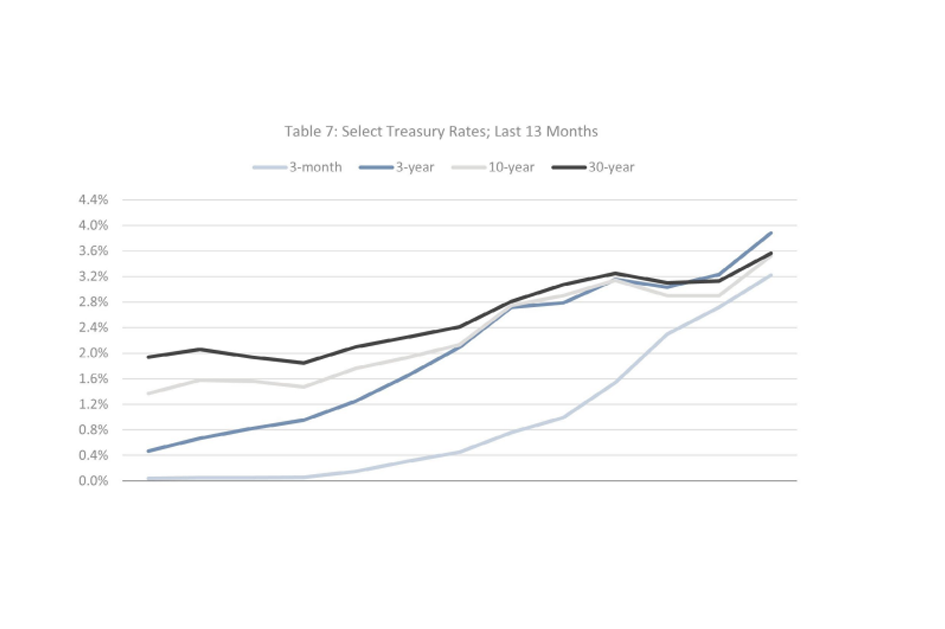

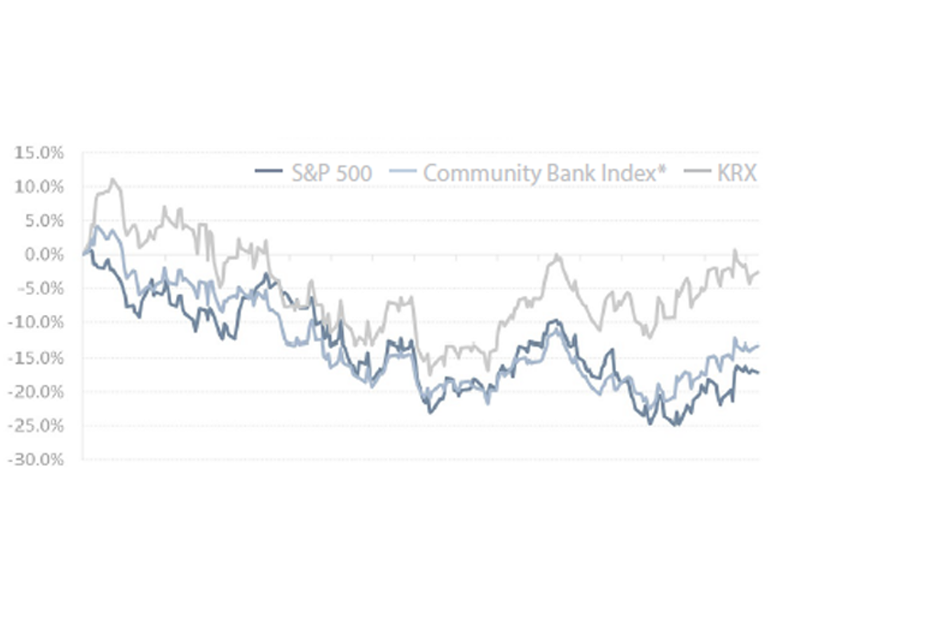

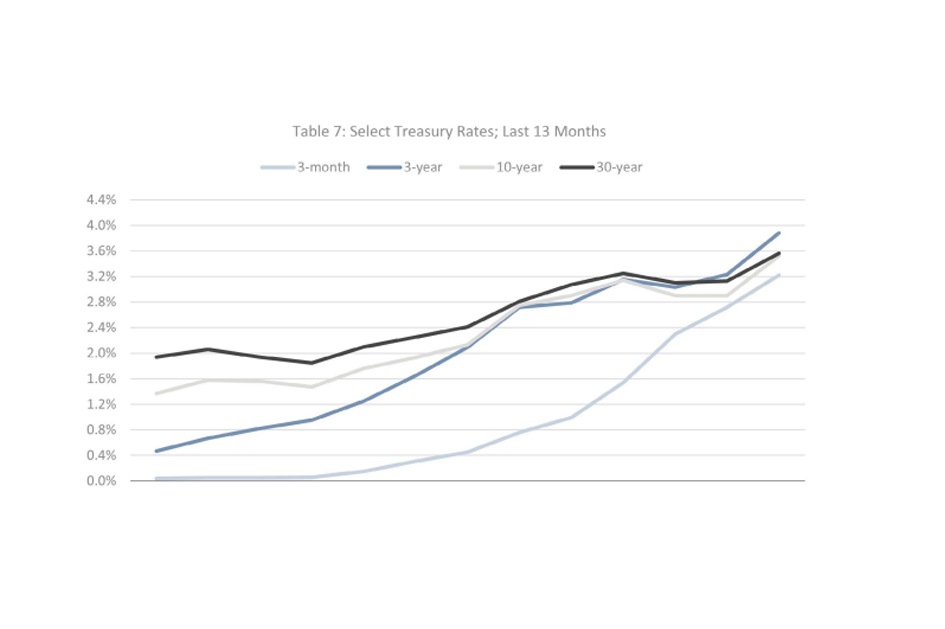

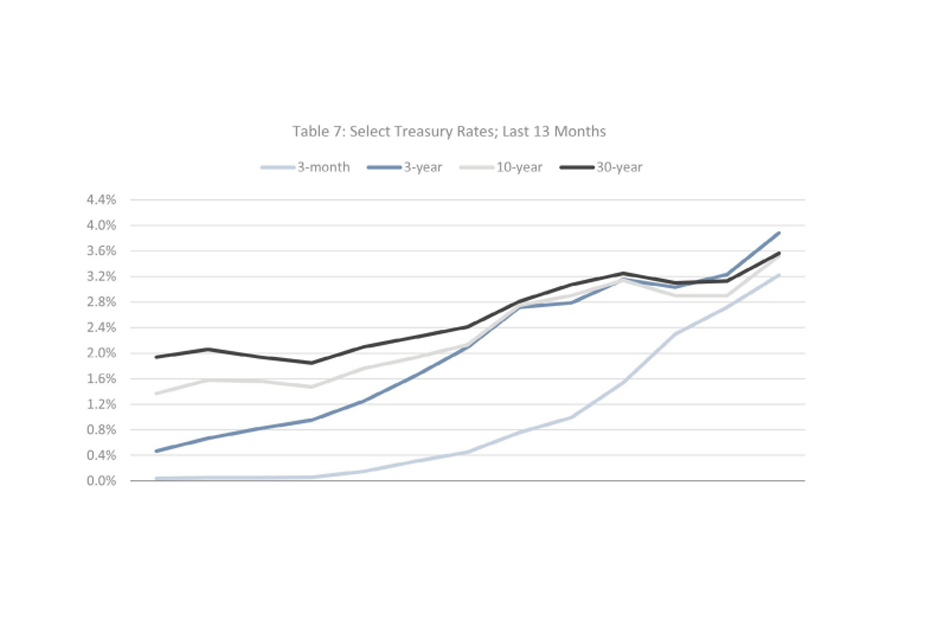

Rates Go Up, You Lock In

With the Federal Open Market Committee (FOMC) predicting four to five more rate hikes in 2022, our members are looking for ways to protect themselves and their balance sheet. Many have found value in the Forward Settling Advance (FSA), which hedges against rising rates and provides you an opportunity to lock in before additional FOMC increases.

Financial Intelligence

Financial Intelligence

November 8, 2022

Second Quarter 2022 Economic Update

Despite strength in labor-related indicators and updated forecasts predicting positive economic growth in the third quarter of 2022, expectations remain that the U.S. economy will soon be in a recession.

Financial Intelligence

Financial Intelligence

August 8, 2022

Rates Go Up, You Lock In

With the Federal Open Market Committee (FOMC) predicting four to five more rate hikes in 2022, our members are looking for ways to protect themselves and their balance sheet. Many have found value in the Forward Settling Advance (FSA), which hedges against rising rates and provides you an opportunity to lock in before additional FOMC increases.

Financial Intelligence

Financial Intelligence

August 3, 2022

First Quarter 2022 Economic Update

First Quarter 2022 Quarterly Economic Update | This analysis provides economic data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

August 3, 2022

First Quarter 2022 Economic Update

First Quarter 2022 Quarterly Economic Update | This analysis provides economic data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

July 20, 2022

Beta Preparation

Two things have remained consistent since the start of the pandemic – uncertainty and speed. As the Federal Open Market Committee (FOMC) combats inflation by rapid tightening with the historic rate increases and pace garnering greater publicity, deposit customers are beginning to seek more attractive yields.

Financial Intelligence

Financial Intelligence

July 20, 2022

Beta Preparation

Two things have remained consistent since the start of the pandemic – uncertainty and speed. As the Federal Open Market Committee (FOMC) combats inflation by rapid tightening with the historic rate increases and pace garnering greater publicity, deposit customers are beginning to seek more attractive yields.

Financial Intelligence

Financial Intelligence

July 8, 2022

1Q 2022 Community Financial Institution Trends

Quarterly Analysis for 1Q 2022 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

July 8, 2022

1Q 2022 Community Financial Institution Trends

Quarterly Analysis for 1Q 2022 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

May 3, 2022

Fourth Quarter 2021 Economic Update

After a tumultuous 2020, preliminary Real Growth Domestic Product (GDP) looks to close out 2021 with a major rebound. On average, Tenth District (District)* states have fared slightly worse than the rest of the U.S./r/n /r/nDespite the drag of COVID-19 on the travel industry, Colorado has proven most resilient among District states. Housing, construction and population growth continues to boom, while tech and information-driven industries have kept Colorado afloat. Colorado's 6% GDP growth was 26th among U.S. states in the fourth quarter 2021./r/n /r/nUntil fourth quarter 2021, the agricultural and manufacturing-focused states of Kansas and Nebraska generally managed more favorably than the rest of the country during 2021’s recovery. However, weakness in agriculture, forestry, fishing and hunting served as a major drag to the “Plains,” dropping Kansas and Nebraska’s real GDP growth by 4% and 5.6%, respectively.

Financial Intelligence

Financial Intelligence

April 18, 2022

Smart Moves for Every Scenario

If there's a word that stands out from Chairman Powell's comments leading up to the Federal Reserve's next rate decision, it's "expeditiously."

Financial Intelligence

Financial Intelligence

May 3, 2022

Fourth Quarter 2021 Economic Update

After a tumultuous 2020, preliminary Real Growth Domestic Product (GDP) looks to close out 2021 with a major rebound. On average, Tenth District (District)* states have fared slightly worse than the rest of the U.S./r/n /r/nDespite the drag of COVID-19 on the travel industry, Colorado has proven most resilient among District states. Housing, construction and population growth continues to boom, while tech and information-driven industries have kept Colorado afloat. Colorado's 6% GDP growth was 26th among U.S. states in the fourth quarter 2021./r/n /r/nUntil fourth quarter 2021, the agricultural and manufacturing-focused states of Kansas and Nebraska generally managed more favorably than the rest of the country during 2021’s recovery. However, weakness in agriculture, forestry, fishing and hunting served as a major drag to the “Plains,” dropping Kansas and Nebraska’s real GDP growth by 4% and 5.6%, respectively.

Financial Intelligence

Financial Intelligence

April 18, 2022

Smart Moves for Every Scenario

If there's a word that stands out from Chairman Powell's comments leading up to the Federal Reserve's next rate decision, it's "expeditiously."

Financial Intelligence

Financial Intelligence

March 30, 2022

4Q 2021 Community Financial Institutions Trends

Quarterly Analysis for 4Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

March 1, 2022

A Match Made in Homeownership

You are most likely aware of the Mortgage Partnership Finance® (MPF) Program and its availability to you as a member of FHLBank Topeka for delivering eligible loans into the secondary market. You may also be aware of our Homeownership Set-aside Program (HSP) which provides down payment, closing cost and repair assistance for first-time homebuyers. What you may not be aware of is how well these two programs can work together.

Financial Intelligence

Financial Intelligence

February 18, 2022

Don’t Predict, Prepare

We examined recent comments from the Federal Reserve and devised a few scenarios to help our members prepare for what’s next.

Financial Intelligence

Financial Intelligence

March 30, 2022

4Q 2021 Community Financial Institutions Trends

Quarterly Analysis for 4Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

March 1, 2022

A Match Made in Homeownership

You are most likely aware of the Mortgage Partnership Finance® (MPF) Program and its availability to you as a member of FHLBank Topeka for delivering eligible loans into the secondary market. You may also be aware of our Homeownership Set-aside Program (HSP) which provides down payment, closing cost and repair assistance for first-time homebuyers. What you may not be aware of is how well these two programs can work together.

Financial Intelligence

Financial Intelligence

February 18, 2022

Don’t Predict, Prepare

We examined recent comments from the Federal Reserve and devised a few scenarios to help our members prepare for what’s next.

Financial Intelligence

Financial Intelligence

January 5, 2022

Third Quarter 2021 Economic Update

After a tumultuous 2020 with the pandemic ravaging state economies across the country, preliminary Real Growth Domestic Product (GDP) figures for 2021 second quarter indicate a major rebound. On average, Tenth District (District)* states have fared slightly worse than the rest of the U.S./r/n /r/nDespite the drag of the pandemic on the travel industry, Colorado has proven most resilient to the shutdown among District states. Housing and construction continues to boom, while tech and information-driven industries also kept Colorado afloat. 7.2 percent GDP growth was 11th among U.S. states in the second quarter of 2021.

Financial Intelligence

Financial Intelligence

January 5, 2022

Third Quarter 2021 Economic Update

After a tumultuous 2020 with the pandemic ravaging state economies across the country, preliminary Real Growth Domestic Product (GDP) figures for 2021 second quarter indicate a major rebound. On average, Tenth District (District)* states have fared slightly worse than the rest of the U.S./r/n /r/nDespite the drag of the pandemic on the travel industry, Colorado has proven most resilient to the shutdown among District states. Housing and construction continues to boom, while tech and information-driven industries also kept Colorado afloat. 7.2 percent GDP growth was 11th among U.S. states in the second quarter of 2021.

Financial Intelligence

Financial Intelligence

December 23, 2021

3Q 2021 Community Financial Institutions Trends

Quarterly Analysis for 3Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

December 23, 2021

3Q 2021 Community Financial Institutions Trends

Quarterly Analysis for 3Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

September 21, 2021

2Q 2021 Community Financial Institutions Trends

Quarterly Analysis for 2Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

August 6, 2021

Strategies for Success

Excess liquidity continues to linger for many of our members.

Financial Intelligence

Financial Intelligence

September 21, 2021

2Q 2021 Community Financial Institutions Trends

Quarterly Analysis for 2Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

August 6, 2021

Strategies for Success

Excess liquidity continues to linger for many of our members.

Financial Intelligence

Financial Intelligence

July 23, 2021

1Q 2021 Tenth District Community Financial Institution Trends

Quarterly Analysis for 1Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

July 23, 2021

1Q 2021 Tenth District Community Financial Institution Trends

Quarterly Analysis for 1Q 2021 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

May 19, 2021

First Quarter 2021 Economic Update

Despite strong rebounds in the third quarter of 2020 and positive growth in the fourth quarter, preliminary Real Gross Domestic Product (GDP) 2020 growth rates among Tenth District (District)* states closed the year negative.

Financial Intelligence

Financial Intelligence

May 19, 2021

First Quarter 2021 Economic Update

Despite strong rebounds in the third quarter of 2020 and positive growth in the fourth quarter, preliminary Real Gross Domestic Product (GDP) 2020 growth rates among Tenth District (District)* states closed the year negative.

Financial Intelligence

Financial Intelligence

February 18, 2021

Fourth Quarter 2020 Economic Update

Third quarter Real Gross Domestic Product (GDP) growth rates among Tenth District* states reflect a reversal of the negative trend

Financial Intelligence

Financial Intelligence

February 18, 2021

Fourth Quarter 2020 Economic Update

Third quarter Real Gross Domestic Product (GDP) growth rates among Tenth District* states reflect a reversal of the negative trend

Financial Intelligence

Financial Intelligence

December 9, 2020

3Q 2020 Community Financial Institutions Trends

Quarterly Analysis for 3Q 2020 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

November 6, 2020

Overnight Line of Credit Makes Institutions More Efficient

Even in these times of high liquidity and limited investment options, many FHLBank Topeka members continue to use their FHLBank overnight line of credit (OLOC) to help manage their daily cash position.

Financial Intelligence

Financial Intelligence

October 23, 2020

Exposing the Fallacy of the Loan-to-Deposit/Share Ratio

Exposing the Fallacy of the Loan-to-Deposit/Share Ratio. We commonly hear from our members that one of the reasons they choose to use either brokered deposits or online listing service deposits instead of FHLBank advances is their desire to improve the institution’s loan-to-deposit/share (LTD) ratio./r/n /r/n /r/nGet Whitepaper

Financial Intelligence

Financial Intelligence

December 9, 2020

3Q 2020 Community Financial Institutions Trends

Quarterly Analysis for 3Q 2020 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

November 6, 2020

Overnight Line of Credit Makes Institutions More Efficient

Even in these times of high liquidity and limited investment options, many FHLBank Topeka members continue to use their FHLBank overnight line of credit (OLOC) to help manage their daily cash position.

Financial Intelligence

Financial Intelligence

October 23, 2020

Exposing the Fallacy of the Loan-to-Deposit/Share Ratio

Exposing the Fallacy of the Loan-to-Deposit/Share Ratio. We commonly hear from our members that one of the reasons they choose to use either brokered deposits or online listing service deposits instead of FHLBank advances is their desire to improve the institution’s loan-to-deposit/share (LTD) ratio./r/n /r/n /r/nGet Whitepaper

Financial Intelligence

Financial Intelligence

October 14, 2020

2Q 2020 Community Financial Institutions Trends

Quarterly Analysis for 2Q 2020 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

September 16, 2020

More “core” than core deposits

Historically core deposits from an institution’s immediate market area provided the funds that enabled an institution to make loans and invest in income generating assets.

Financial Intelligence

Financial Intelligence

October 14, 2020

2Q 2020 Community Financial Institutions Trends

Quarterly Analysis for 2Q 2020 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

September 16, 2020

More “core” than core deposits

Historically core deposits from an institution’s immediate market area provided the funds that enabled an institution to make loans and invest in income generating assets.

Financial Intelligence

Financial Intelligence

August 11, 2020

Second Quarter 2020 Economic Update

Real Gross Domestic Product (GDP) growth among Tenth District* states was negative in Q1 2020. All four states were above to slightly above the national rate of -5.0%.

Financial Intelligence

Financial Intelligence

August 11, 2020

Second Quarter 2020 Economic Update

Real Gross Domestic Product (GDP) growth among Tenth District* states was negative in Q1 2020. All four states were above to slightly above the national rate of -5.0%.

Financial Intelligence

Financial Intelligence

June 1, 2020

1Q 2020 Community Financial Institutions Trends

Quarterly Analysis for 1Q 2020 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

June 1, 2020

1Q 2020 Community Financial Institutions Trends

Quarterly Analysis for 1Q 2020 | This analysis provides financial and performance trend data for member institutions in FHLBank’s Tenth District comprised of Colorado, Kansas, Nebraska and Oklahoma.

Financial Intelligence

Financial Intelligence

April 28, 2020

First Quarter 2020 Economic Update

Real Gross Domestic Product (GDP) growth among Tenth District* states was positive, but the same as or down from year-end (YE) 2018.

Financial Intelligence

Financial Intelligence

April 24, 2020

Mortgage Servicing Marketplace in the Face of the COVID Pandemic

We are currently witnessing a global economic slowdown due to the COVID-19 outbreak

Financial Intelligence

Financial Intelligence

April 28, 2020

First Quarter 2020 Economic Update

Real Gross Domestic Product (GDP) growth among Tenth District* states was positive, but the same as or down from year-end (YE) 2018.

Financial Intelligence

Financial Intelligence

April 24, 2020

Mortgage Servicing Marketplace in the Face of the COVID Pandemic

We are currently witnessing a global economic slowdown due to the COVID-19 outbreak

Financial Intelligence

Financial Intelligence

February 18, 2020

Fourth Quarter 2019 Economic Update

Tenth District Economic Update For the Fourth Quarter of 2019. Real Gross Domestic Product (GDP) growth among Tenth District states was positive and improved from year-end 2018 to Q3 2019 in all states but Colorado, and all states but Oklahoma outpaced the U.S. growth rate in Q3.

Financial Intelligence

Financial Intelligence

December 23, 2019

New reference rate

LIBOR has been in the financial news since July 2017 when the UK’s Financial Conduct Authority decided to phase out this reference rate, which over $350 trillion in financial products are based upon. Ralph Waldo Emerson said it best with this quote, “The future belongs to those who prepare for it.” If you have not started a plan to address the LIBOR transition, now is the time to begin.

Financial Intelligence

Financial Intelligence

February 18, 2020

Fourth Quarter 2019 Economic Update

Tenth District Economic Update For the Fourth Quarter of 2019. Real Gross Domestic Product (GDP) growth among Tenth District states was positive and improved from year-end 2018 to Q3 2019 in all states but Colorado, and all states but Oklahoma outpaced the U.S. growth rate in Q3.

Financial Intelligence

Financial Intelligence

December 23, 2019

New reference rate

LIBOR has been in the financial news since July 2017 when the UK’s Financial Conduct Authority decided to phase out this reference rate, which over $350 trillion in financial products are based upon. Ralph Waldo Emerson said it best with this quote, “The future belongs to those who prepare for it.” If you have not started a plan to address the LIBOR transition, now is the time to begin.

Financial Intelligence

Financial Intelligence

October 3, 2019

Safety in numbers

Accepting public unit deposits is an important part of supporting your community. How can you do this in a safe and efficient way? Many members are turning to the FHLBank letter of credit.

Financial Intelligence

Financial Intelligence

July 10, 2019

Member Insights

We know our members have many choices when it comes to funding. What sets FHLBank products apart?

Financial Intelligence

Financial Intelligence

October 3, 2019

Safety in numbers

Accepting public unit deposits is an important part of supporting your community. How can you do this in a safe and efficient way? Many members are turning to the FHLBank letter of credit.

Financial Intelligence

Financial Intelligence

July 10, 2019

Member Insights

We know our members have many choices when it comes to funding. What sets FHLBank products apart?